Kean University Foundation Launches Student-Run Endowment to Foster Real-World Financial Expertise

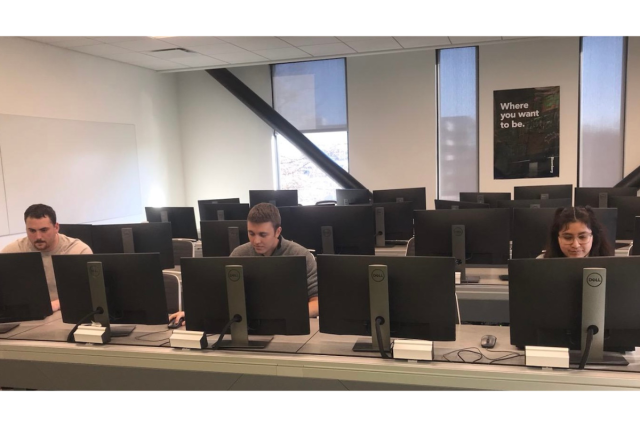

Kean students (left to right) Garrett Terlizzi, Anthony Bogash, Melanie Huashuayo, and Alessandro Dileo (not pictured), are managing a Kean University Foundation fund to benefit current and future students.

The Kean University Foundation this month launched a fund managed by Kean students who will gain real-world experience in working with the investment portfolio.

The Student-Run Endowment (SRE), a fund that students can use to research and invest in stocks, bonds or other financial assets, will receive $50,000 in funding from the Foundation. Four students in the College of Business and Public Management (CBPM) – MBA student Anthony Bogash ’23, senior Garrett Terlizzi, and juniors Alessandro Dileo and Melanie Huashuayo – make all the investment decisions with guidance from assistant professors Ahmed Alam, Ph.D., and Andreas Kakolyris, Ph.D., their faculty co-advisors. Gains generated by the fund will be used to enhance educational experiences for Kean Cougars.

“This initiative provides Kean students with real money to build a fund for the benefit of current and future students,” said Kean President Lamont O. Repollet, Ed.D. “You can’t get better experience or training for a job on Wall Street. We are proud to be able to offer this experiential learning opportunity with the support of the Kean University Foundation.”

The initiative bridges the gap between classroom learning and practical financial decision-making.

"We believe in the potential of our students to excel not only in their academic pursuits but also in real-world applications of their knowledge," said Bill Miller, chief executive officer of the Kean University Foundation. "The Student-Run Endowment is a testament to our dedication to providing transformative experiences beyond traditional education."

The finance students were selected for the SRE based on their GPAs, faculty recommendations, and their strong interest in managing the fund. They each researched a sector and recommended stocks or funds. On Wednesday, December 6, the team made its first investments, creating a balanced portfolio of individual stocks and index funds.

“I have utilized the topics and concepts I learned in class,” said Huashuayo, of New Providence. “I take every trade seriously, as real money is involved.”

The real-life rewards and consequences make the student-run fund “thrilling and challenging at the same time,” according to Kakolyris.

“Compared with its virtual counterpart, trading with real money requires a higher level of dedication and professionalism,” he said. “It reminds the students that they can’t afford to lose while making sure that they are not taking too much risk.”

The Foundation anticipates the Student-Run Endowment will become a cornerstone in the University's commitment to fostering innovation, critical thinking and practical skills development.

“Our mission is to transform diverse students into impactful global community members through engaged learning,” said Jin Wang, Ph.D., CBPM dean. “There is no better way to engage students in learning than having them utilize our Bloomberg Terminal Lab to manage this fund.”

Bogash, of Clark, valedictorian at Kean’s 2023 Commencement, said he has been “fascinated by the power of financial markets” since taking his first finance class as a Kean undergraduate. He called it an honor to be entrusted with managing the fund.

“Although simulated portfolios are a great educational tool, there is no substitute for the real thing. The decisions we make could have major consequences on University funds,” he said.

The team is dealing with realities that don’t come with simulated stock trading, such as commissions, dividends, mergers and acquisitions, and more. The students say they have a fiduciary obligation to act in the best interests of the University.

“A key priority in finance is to maximize value for shareholders,” said Dileo, of Toms River. “No matter the stakes, investment decisions should always be made on a factual, objective basis.”

Terlizzi, of Brielle, hopes the fund will continue to grow with investments from this team and others in the future.

“The initiative is a step forward for Kean's efforts to prepare students for life after college,” he said. “I recommend all students, regardless of their major, try to open a basic portfolio and invest for themselves.”