EOF Freshman Admission

EOF Freshman Eligibility

In order to be considered for freshman admission into the EOF Program at Kean University, an applicant:

- Must be a U.S. citizen or permanent resident.

- Is required to be a New Jersey resident for at least one year prior to enrollment at Kean University.

- Must fully complete the admissions application process.

- Must meet the income eligibility guidelines for household income based on size as determined annually by the State of New Jersey, Office of the Secretary of Higher Education, Educational Opportunity Fund.

- Has an educational background that shows need for improvement of academic skills.

- Intends to enroll full-time (at least 12 credits per semester).

- May attend a high school and/or live in a targeted socioeconomic area as identified by the State of New Jersey, Office of the Secretary of Higher Education, Educational Opportunity Fund.

- May have successfully completed a New Jersey Gear UP/College Bound/Upward Bound Program.

- May have a sibling who was or is enrolled in an EOF Program in New Jersey.

- May be eligible for government assistance and/or educational programs for low-income or disadvantaged populations (TRIO programs, free and reduced breakfast/lunch, food stamps).

- NJ Dreamers are eligible to apply for the EOF Program. Students must graduate from a New Jersey high school, have attended for three years and cannot be visiting the U.S. on a visa.

Applying to the EOF Program

- Fill out an undergraduate admissions application online at www.kean.edu.

- Make sure to indicate you are applying for the EOF Program by selecting “EOF Freshman" on the Common Application or Kean University online application.

- Complete the EOF Supplemental Application on your Kean Cougar Application Portal

- If you did not request EOF at the time of application, email EOFAdmissions@kean.edu and request to have the EOF Supplemental Application placed on your application portal

- To be considered for admission as an EOF Freshman, you must be eligible for the EOF grant and meet the above household income guideline. To review your application for EOF eligibility, please complete and submit the following:

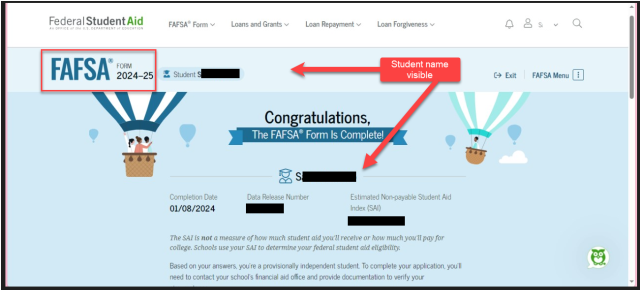

- Proof of 2026-27 FAFSA Completion

- Please add Kean University as one of your college choices on your FAFSA

- Proof of completion must show your name and could be any of the following:

- screenshot of completion confirmation page (see below)

- copy of email confirmation of completion

- first page of 26-27 Student Aid Report (SAR)

-

If you are an NJ DREAMER:

-

Complete the New Jersey Alternative Financial Aid Application application and submit proof of completion

-

- Proof of 2026-27 FAFSA Completion

- Video Personal Statement

- Please provide a short ( five minutes max ) video of yourself talking about:

- Your academic history by academic year ( Freshman year through today )

- Your future educational and career goals

- How can EOF assist you in achieving these goals

- Anything else you want us to know about you (i.e., personal challenges overcome, motivation to earn a degree, sources of inspiration )

- Note: Please begin by stating your name, current school, and year of graduation

- Please provide a short ( five minutes max ) video of yourself talking about:

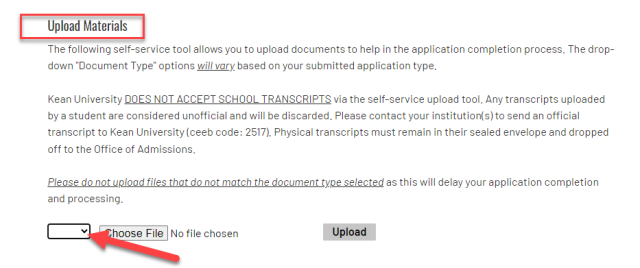

Upload items via your Cougar App Portal

To securely upload the requested items, simply go to the “Upload Materials” section of the Application Information page of your Cougar App Portal.

2026-2027 Academic Year EOF Income Guidelines

|

Household Size |

Maximum Gross Household Income |

Maximum Asset Cap for ALL Students |

|

1 |

$31,300 |

$6,260 |

|

2 |

$42,300 |

$8,460 |

|

3 |

$53,300 |

$10,660 |

|

4 |

$64,300 |

$12,860 |

|

5 |

$75,300 |

$15,060 |

|

6 |

$86,300 |

$17,260 |

|

7 |

$97,300 |

$19,460 |

|

8 |

$108,300 |

$21,660 |

|

For each additional household member |

$11,000 |

$2,200 |

Your offer of admission into the EOF Program as a freshman is contingent upon the following:

- Pay the Kean University tuition deposit

- Schedule your placement test and academic advising appointment

- Attend the EOF Orientation - Saturday, June 6th

- Attend and successfully complete the Summer 2026 Summer Academy - June 28th (move-in date)- July 30th*

* dates subject to change

Additional Questions?

If you have any questions about EOF and/or the EOF application process, please email us at EOFAdmissions@kean.edu