Student Participant Stipends

What is a grant-funded student participant stipend?

Under Federal Guidelines, stipends or Fellowships are defined as support paid to or on the behalf of participants or trainees but not employees. They include, but are not limited to:

- Subsistence Allowances,

- Travel Allowances,

- – Meal Allowances

- Housing Allowances,

- Registration Fees,

- Etc…

What is Kean’s Process for processing stipends on sponsored projects?

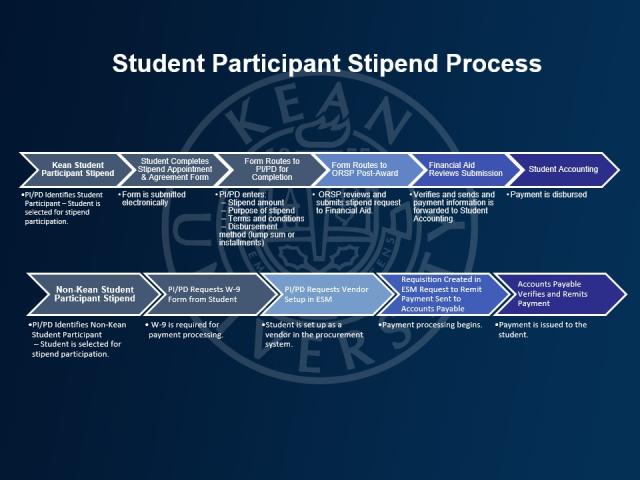

- To ensure compliance, the following methods must be used:

- Kean Student Participants must be processed through Financial Aid. The funds provided will need to be reviewed as part of their allowable aid package. Financial Aid will determine the impact on the aid package for each participant.

- Non-Kean Student Participants must be processed through ESM procurement as a vendor.

- First, the non-Kean student will need to be set up as a vendor ESM. The student will need to supply Kean with their W-9 to ensure the correct address for the stipend payment.

How to request a Kean Student Participant Stipend

Step 1:

The Principal Investigator (PI) or Project Director (PD) provides the Kean student with the Student Participant Stipend Appointment & Acknowledgement Form, CLICK HERE. ORSP will not accept stipend payment requests submitted via email.

Step 2:

The student and PI/PD complete the form. The PI/PD should reference the stipend deadline calendar to ensure the request is submitted in accordance with published deadlines.

Step 3:

Once submitted, the form is automatically routed to the ORSP Post-Award office. Post-Award staff will verify the information and submit the stipend request to the Office of Financial Aid based on the stipend deadline calendar.

Financial Aid and Student Accounting Responsibilities

All stipend requests are reviewed by Financial Aid and Student Accounting to ensure they contain the necessary and appropriate information for payment. If approved, Student Accounting processes the payment accordingly.

More information about Financial Aid Disbursement

Inquiries:

ALL inquiries related to student stipend payments should be directed to the Office of Student Accounting, located on the 3rd Floor of the Administration Building on the Kean University Union campus.

For General Inquiries: stuactg@kean.edu

Stipend Deadlines

Payment Dates are estimated and subject to change without notice.

| Stipend Request Deadline | Estimated Posting Date |

Student Accounting |

|---|---|---|

| 07/15/2025 (Tues) | Week of 07/22/2025 | Week of 08/04/2025 |

| 08/13/2025 (Wed) | Week of 08/20/2025 | Week of 09/08/2025 |

| 10/08/2025 (Wed) | Week of 10/22/2025 | Week of 11/03/2025 |

| 11/06/2025 (Thu) | Week of 11/20/2025 | Week of 12/01/2025 |

| 12/02/2025 (Tues) | Week of 12/16/2025 | Week of 01/06/2026 |

| 02/05/2026 (Thu) | Week of 02/19/2026 | Week of 03/02/2026 |

| 03/05/2026 (Thu) | Week of 03/19/2026 | Week of 04/06/2026 |

| 04/08/2026 (Wed) | Week of 04/22/2026 | Week of 05/04/2026 |

| 05/06/2026 (Wed) | Week of 05/20/2026 |

Week of 06/01/2026 |

| 06/03/2026 (Wed) | Week of 06/17/2026 | Week of 06/30/2026 |

| 07/08/2026 (Wed) | Week of 07/22/2026 | Week of 08/03/2026 |

| 08/05/2026 (Wed) | Week of 08/19/2026 | Week of 09/08/2026 |

Kean's Student Participant Stipend Policy Definition

Grant-Funded Student Participant Stipends are not compensation, and cannot be paid, for services rendered. A stipend is distinct from wages or salaries because it is not intended to compensate a student for work performed. Rather, it is intended to free up a student to undertake a role in connection with educational studies or research that would normally be uncompensated. Work without a direct connection to a student’s educational studies or research is not appropriate for stipends.

Policy

The general rule is that any income is subject to federal taxation, but scholarships and fellowships are excluded from taxation when the award is a qualified scholarship given to the degree-

seeking recipient for the purpose of studying or conducting research at an educational institution. Section 117 of the Internal Revenue Code (26 U.S.C. 117) applies to the tax treatment of

scholarships and fellowships. In general, students bear the tax burden; federal government agencies require students to determine taxation of scholarships and fellowships when filing annual income tax returns.

A stipend is only tax free when (1) the recipient is a currently enrolled Kean student AND (2) the stipend is used for: tuition and fees or books, supplies and equipment that are required for coursework. Expenses that are NOT tax exempt include room and board, travel, research costs, and equipment and supplies not required for enrollment.

Determination of whether a stipend will impact a student’s financial aid package is determined by the Office of Financial Aid, not ORSP. They will work with the student (if necessary, with ORSP) to adjust the student’s financial aid and/or stipend so the student’s total aid from all sources is within the cost of attendance (COA). ORSP is neither able to make this determination, nor coordinate a reply from the Office of Financial Aid on the students’ behalf. Any questions regarding impacts on financial aid must be directed to the same office by the payee.